|

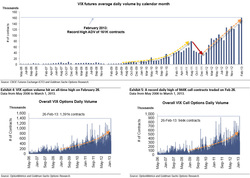

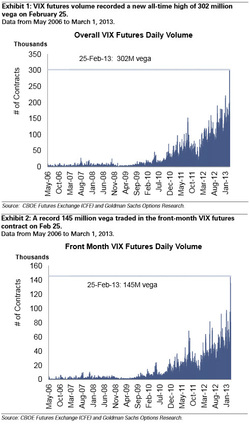

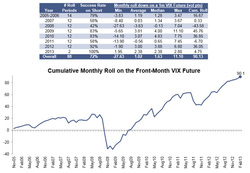

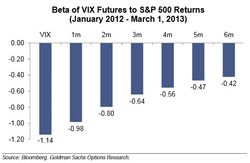

An excellent post from Zerohedge (4 March, 2013) - VIX 'Sell-And-Roll' Volume Explodes, Replacing Equity 'Buy-And-Hold' In The New Normal With the heavy central-planning boot of repression on the neck of any and all realized risky asset volatility, it is perhaps no surprise that investors, professional and amateur alike, have been dragged into the latest yield-enhancing 'scheme' of being short front-month vol and earning the premium. Bernanke has created a world of insurance providers - who are fundamentally under-capitalized when the big one hits - as record high levels of net short positions, record volumes, and extreme beta to stocks leave the bevy of option premium sellers still consistently picking up nickels in front of that steam-roller. Of course, as Taleb reminds, suppressing volatility actually makes the world a less predictable and more dangerous place - though for now, it seems, everyone and their eTrade baby is willing to follow Kevin Henry down the vol-premium selling route until of course that steam-roller tears more than just an arm off (given the massive and levered exposure to this market now). Instead of equity 'Buy-and-Hold'; the new normal is 'Sell Vol-and-Roll. Perhaps a re-read of Taleb's Foreign Affairs article is worth while.

Comments are closed.

|

A source of news, research and other information that we consider informative to investors within the context of tail hedging.

The RSS Feed allows you to automatically receive entries

Archives

June 2022

All content © 2011 Lionscrest Advisors Ltd. Images and content cannot be used or reproduced without express written permission. All rights reserved.

Please see important disclosures about this website by clicking here. |

RSS Feed

RSS Feed