|

Fcommentary on current elevated tail-risk in global asset prices.

----- By Alastair Thomas June 30, 2013 Interest rates are largely driven by monetary policies and expectations of how these may evolve. Several large central banks have entered unconventional monetary policies in the last few years, most notably the US Federal Reserve, the Bank of England and the Bank of Japan. One of the main forms of unconventional monetary policy has been asset purchases. Early announcements of asset purchases in advanced economies lifted prices globally, as they decreased the tail risk of a severe recession, but their effects diminished once markets normalised. These policies have no doubt promoted the economic recovery and reduced the risk of deflation – and helped reduce long-term bond yields in the process. However, the benefits of large-scale asset purchases and persistently low rates need to be weighed against the potential costs, such as excessive risk-taking, the distortion of the sovereign debt and credit markets, and the impact on market functioning. If purchases are perceived to be monetising debt then there is a risk of adverse effects on interest rates and the real economy. Furthermore, purchases can delay fiscal, structural and financial sector reforms and lead to distortions in exchange rates. The dilemma that central banks face is when such monetary stimulus should be reduced. They need to determine whether any economic growth is part of a sustainable recovery or if it is only temporary. In the case of the former, then they should reduce such stimulus. If not, then it may be best to wait, but that can result in greater risks of increased inflation expectations. Many of the reasons why the US Fed announced additional purchases (or quantitative easing) late last year have not materialised: a weakening labour market, risks from Europe (mitigated by the European Central Bank’s “outright monetary transactions” programme announced last summer) and the fiscal cliff. Some investors and central bankers are now starting to be concerned about “financial stability”, as all asset prices move higher rather than just those that have a direct impact on the consumer’s balance sheet. The US economy is undeniably slowly picking up and some of the main metrics that the Fed considers are probably close to target for making changes to monetary policy. Non-farm payroll increases have been good but others are still of concern. The headline unemployment rate is still high, the hiring rate is still too low, wage growth is not strong enough, labour market participation is low and there have been other mixed economic data. The low inflation prints may assist in the prolonging of QE, although the Fed believes this state to be transitory. However, the key to the decision to taper QE will be based not on the most recent economic data, but the Fed’s forecasts for these data. The Fed still seems fairly confident that the recovery will pick up in the second half of the year. If it gets enough data to support this view then we could see tapering as soon as the autumn, even if rate hikes will not follow for quite some time after the asset purchases have finally ceased. However, the exit process may prove challenging. There is a risk of much higher interest rate volatility and an overshoot in the adjustment of longer-term rates. Large rate moves when purchases are reduced could undermine the recovery and cause big changes in capital flows and exchange rates and put pressure on government finances. The International Monetary Fund’s research paper on unconventional monetary policy states that “central banks in advanced economies should in principle be able to limit the risk of a sharp increase in long-term rates. Enhanced forward guidance and improved communication could help guide expectations of future policy rates.” The general move to higher long-term rates as QE is reduced may also be countered by lower net Treasury issuance as the budget deficit reduces on higher tax receipts as the economy improves. Also, the impact of the Bank of Japan’s $850bn a year of asset purchases may help drive down real yields in Japan (as inflation expectations increase) forcing Japanese investors to seek yield elsewhere, including in US equities and Treasuries. In conclusion, investors should monitor economic data carefully and be prepared for longer-term rates to move higher. Ten-year US yields of 3 or 4 per cent will seem low in a historic context, even if considerably higher than the current level. As the IMF states in the conclusion of its paper on unconventional monetary policies “the path ahead will be challenging, with many unknowns”. Alastair Thomas is head of rates and treasury management at ECM Asset Management Jim Rogers speaks to the risks imbedded in financial markets due to excessive central bank money printing - highlights the extreme level of tail-risk in fi.

----- June 26, 2013 | By Tekoa Da Silva I was able to reconnect with Jim Rogers this morning out of Spain, legendary co-founder of the Quantum Fund with George Soros, author of Hot Commodities, and chairman of the private Beeland Holdings. It was an especially powerful interview, as Jim spoke towards the relentless downward pressure on gold, the upward explosion in interest rates, central bank money printing, and how to protect yourself ahead of the disastrous times he sees coming. When asked if we’re seeing forced liquidation leading the smash down in gold this morning, Jim said, “We certainly are. There are a lot of leveraged players who are now being forced to sell. Usually when you have this kind of forced liquidation, you’re getting closer to a bottom, maybe not the final bottom, but certainly close to a bottom. I even bought a little bit [today].” With regard to the intense bearish news stories being published on gold, Jim suggested investors shouldn’t ”Pay [much] attention to other people. I pay attention to what’s going on…Obviously with gold collapsing I know about that—but I don’t listen to other people.” Over the last few years Jim has spoken extensively on shorting government bonds, and more recently, the 10-year U.S. treasury yield has rocketed higher (with a corresponding collapse in value). When asked if now is a good time to be covering those short bond positions, he explained that, “I’m grappling with that question as we speak…I’m not short government bonds, [but rather] I’m short junk bonds on the theory that they will suffer the most when the bond market finally breaks. The junk bonds will go first, [along with] emerging market bonds. So I’m trying to figure out what to do, but I am not covering my shorts [just yet].” Commenting on the Fed’s historical ability to control the bond market, Jim said, “We’re getting to that point where either one of two things are going to happen; either central banks are going to stop all this [money printing], or the market is going to force them to stop it. It looks like we may be having a juncture of both…where the Fed is getting worried…and at the same time, the market is jumping in and saying, ‘Yes, it’s insane what you’re doing, and this has to end.’ So we may have a healthy convergence of both. And if it’s not ending now, it’s going to end sometime in the next year, because this cannot go on—it’s too insane.” When asked about the explosive riots occurring in Brazil, Jim warned to prepare for much more, in that, “This is the first time in history where you’ve had all the central banks in the world printing money at the same time. Europe, Japan, America, and the UK, all, are frantically trying to debase their currencies…I’m afraid that in the end, we’re all going to suffer perhaps, worse then we ever have, with inflation, currency turmoil, and higher interest rates. As I say, this has never happened before, it’s never been a good policy in the long run, so I’m afraid we’re all going to suffer for the rest of this decade from this crazy, crazy money printing.” As a final comment to investors looking to protect themselves from these impending disasters, Jim said, “The way to protect yourself is to own real assets…because that’s the only thing which will protect you as currencies debase.” “If you have money in the financial system and the financial system collapses,” he added, “even though you may have done nothing wrong—you may suffer because somebody else did something wrong. So you need to be very careful about where your assets are in the financial system, or have strict control over them yourself, so that you’re not going to lose them.” Source: Bull Market Thinking http://bullmarketthinking.com/jim-rogers-this-is-too-insane-and-im-afraid-were-all-going-to-suffer-for-the-rest-of-this-decade JPM's Head of Equity Derivatives Strategy, Marko Kolanovic, speaks to heightened tail-risks19/6/2013

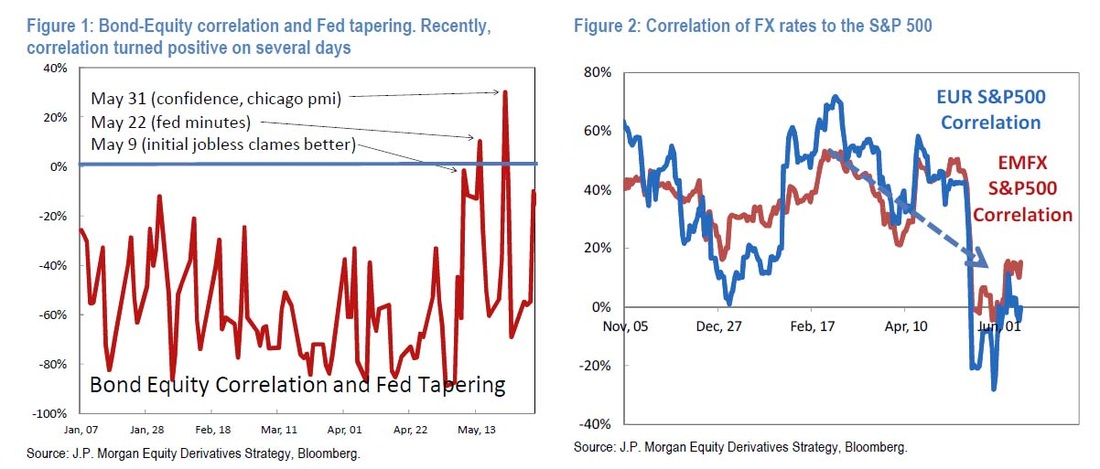

17 June 2013 Over the last 5 years, Treasuries and equities had strong negative correlation. This was the risk-on / risk-off (RORO regime) in which Treasuries were the most broadly used ‘safe haven’ asset. In the RORO regime, investors would hold treasuries and sell them to buy risky assets (and vice versa) while being reassured that Fed will keep the price of Treasuries supported. While we are still on average in a RORO regime, the bond-equity correlation started significantly weakening due to increased risk of Fed tapering and a bond selloff. The effect of the Fed reducing the stimulus could result in lower bond prices as well as lower prices of stocks, commodities and other risky assets whose prices were inflated by the Fed’s stimulus. Over the past month, in several instances bonds and stocks moved together as investors re-assessed the probability of early tapering. Figure 1 below shows equity-bond correlation (calculated from high frequency intraday data). Correlation turned positive on May 9, 22, and 31 and most recently over the past few days. May 9th and 31st brought better than expected macro data (jobless claims, consumer confidence and Chicago PMI). Ironically, positive data caused equities and bonds to trade lower on increased probability of tapering (good data were bad for stocks). Similarly, on May 22nd, bonds and stocks sold off as Bernanke indicated the possibility of tapering over the next few meetings. A byproduct of these new bond-equity dynamics is that USD is losing its status as a ‘risk off’ currency. As expectations of more (less) stimulus pushes up (down) treasuries and US stocks (both USD denominated), resulting currency flows are weakening the historical negative USD-equity correlation. Historically, USD had strong negative correlation to equities (i.e. EUR and EM currencies had a positive correlation to equities). This recent relationship is now undermined as treasuries are losing their appeal as a safety asset. This weakening of EM FX and EUR correlation to the S&P 500 (Figure 2) was also helped by investors putting money in US stocks, while avoiding European and Emerging markets in the last leg of market rally. Fears of Fed tapering the massive QE program is now changing bond-equity correlation from a RORO regime towards a ‘Fed Model’ regime (coincidentally, the name ‘Fed Model’ was crafted in 90s long before invention of quantitative easing). We do not think equity-rate correlation will fully revert back to the ‘Fed Model’ regime, but the recent spikes in rate-equity correlation are worrying signs. Recent bouts of positive correlation of equities, bonds and commodities, suggest that the Fed’s stimulus inflated prices of a broad range of financial assets, and removal of the stimulus could create a tail event in which prices of all assets could go down. While it is expected that the Fed will try to avoid such a scenario by maintaining an appropriate level of stimulus, in the absence of more robust growth, this may turn out to be a difficult task (akin to driving a car without brakes). On this account, we expect more volatility in H2 as compared to the first part of the year. To reduce risk of a bond and equity tail event, investors could diversify ‘safe haven’ assets away from treasuries and into other assets that are at lower risk in case of tapering. For instance, investors could increase allocations to cash or equity put options.

Financial Times

June 6, 2103 ‘Who is my mentor? I have inverse mentors: people I learnt to not imitate,’ says the scholar and philosopher. Nassim Nicholas Taleb, 53, is distinguished professor of risk engineering at New York University’s Polytechnic Institute. Following a career in finance, he is now the best-selling author of books that include The Black Swan and Antifragile. ---- What was your childhood or earliest ambition? I was utopian. I found adults and adulthood fundamentally corrupt, self-serving and unclear. I still do but I now find the utopian even more harmful. Public school or state school? University or straight into work? French lycée, whatever that means. University but largely autodidact as almost never attended classes. University is a good place to drink, make friends and discuss books, nothing else. But the education one gets there is way too commoditised. Who was or still is your mentor? My maternal aunt and paternal grand-uncle. They understand collective wisdom, the type of mistakes one may regret as opposed to good mistakes. I also have inverse mentors: people I learnt to not imitate. How physically fit are you? I lift heavy weights and sprint but I am so bad at it that I develop severe injuries. Like now. Ambition or talent: which matters more to success? Both concepts are modernist nonsense. Success is about honour, feeling morally calibrated, absence of shame, not what some newspaper defines from an external metric. How politically committed are you? Independent, with a Burkean bent, anti-centralised state, anti-large corporations, anti-debt – so largely localist, pro-city states and green. Do you consider your carbon footprint? Indeed. I drive a hybrid, moving into an electric car. I only drink tap water, never consume food that’s travelled. Have been moving many lectures to teleconferencing. Do you have more than one home? Not really, one in the US plus a shared family house in Lebanon. I prefer hotel rooms. In what place are you happiest? It is atmosphere-dependent. I am happy everywhere except in places where I see glitz and rich farts. I am happiest in Brooklyn, where the concentration of rich farts is minimal. What would you like to own that you don’t currently possess? Nothing. What’s your biggest extravagance? Books, books and books. What ambitions do you still have? To complete a multi-volume mathematical expression of the ideas of the more philosophical works, with rigorous derivations and proofs. Volume one is complete. What drives you on? I want to put my works under one title, Incerto, in 10 volumes – six philosophical and four mathematical – so people can grasp it all as a single piece. What is the greatest achievement of your life so far? I’ve learnt to never compromise. What has been your greatest disappointment? That I am unable to destroy the economics establishment, the press. If your 20-year-old self could see you now, what would he think? That I am not ashamed to be judged by my 20-year-old self. I swerved on occasion but ultimately stayed in line with what he wanted me to be. If you lost everything tomorrow, what would you do? This is the ethos of Antifragile: thinking about such an event every day so you reduce fragility to adverse events. I’ve lived in preparation for that possibility. Plan B is to move to college dorms. But nothing would be more devastating than reduced access to a technical library. Do you believe in assisted suicide? I believe in a stoic approach to suicide as one ends life on one’s own terms. You need to control destiny. I did not come to this world to live for ever. Make room for others. If you had to rate your satisfaction with your life so far, out of 10, what would you score? Life is not about self-satisfaction but the satisfaction of a sense of duty. It is all or nothing. Nine out of 10 would be total failure. |

A source of news, research and other information that we consider informative to investors within the context of tail hedging.

The RSS Feed allows you to automatically receive entries

Archives

June 2022

All content © 2011 Lionscrest Advisors Ltd. Images and content cannot be used or reproduced without express written permission. All rights reserved.

Please see important disclosures about this website by clicking here. |

RSS Feed

RSS Feed