|

Excerpted:

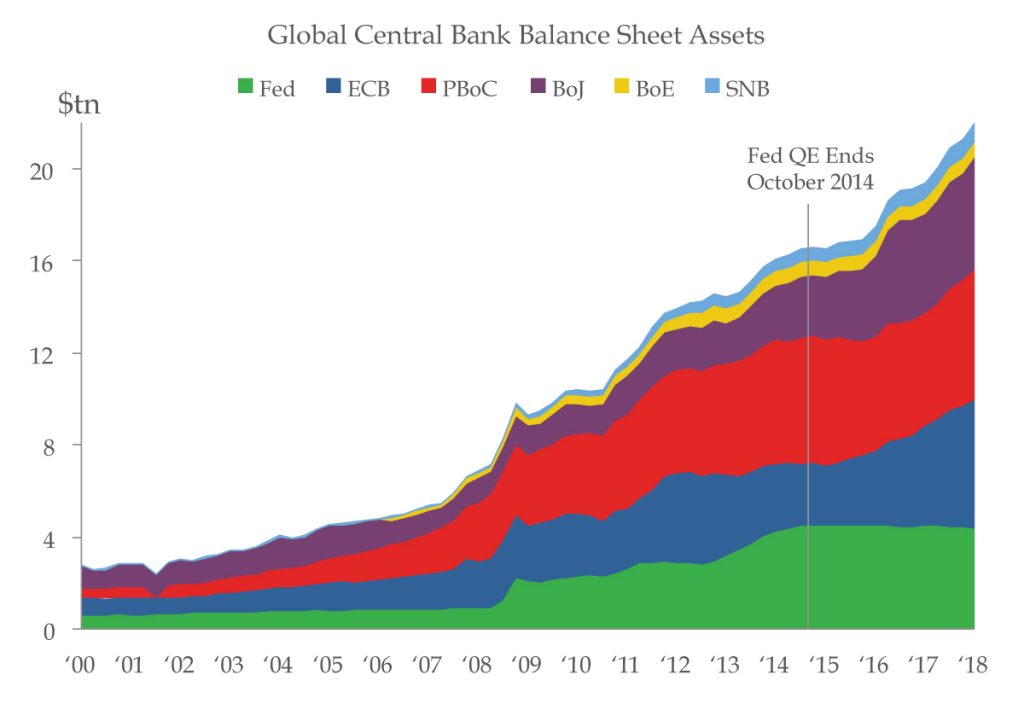

...government debt, which has doubled over the last decade, is set to increase to levels only reached during World War II over the next decade, so we will have sacrificed our future during a relatively peaceful economic period with no post-war reduction simply because politicians can’t say no. This does not exactly measure up to spending to defeat fascism and defend the world’s freedom. Finally, let me address a distortion that is one of the greatest threats to a properly functioning capitalist system. For years now a mix of central – sorry – for years now a mix of financial repression and central bank intervention has made long-term interest rates largely determined by government fiat. Bond-buying by central bankers, commonly referred to as QE, has become so engrained in current thinking that it is now in the Fed’s conventional toolkit, a tool once reserved for a depression or financial crisis is now to be used at the first inkling of the next recession. For those of us old enough to have seen the dangers of price controls, they led to shortages, wasted resources, and disincentives to invest in what consumers want. They inevitably led to an allocation of resources by political actors in another great affront to capitalism. So, it is most surprising that 40 years after wage and price controls were sadly rejected by every economic textbook and policymakers, today we have settled to allowing the most important price of all, long-term interest rates, to be regularly distorted by public intervention. The excuse of this radical monetary policy has been the obsession with a fixed 2.0% inflation targeting rule. The decimal point shows the absurdity of the exercise. Anything below 2.0% was a failure and risked deflation, the boogeyman of the 1930s, to be avoided at all costs. This has meant that years after the Great Recession ended the Fed has not only kept interest rates below inflation but have accumulated an unprecedented $4.5 trillion on their balance sheet by doing QE. Global central banks, in part to keep their currencies from appreciating of these overabundant dollars, have followed with $10 trillion of their own. Now, the irony of this is, over the last 700 years, inflation has averaged barely over 1% and interest rates have averaged just under 6%. So, we are seeing an unprecedented, ultra-monetary, radical monetary expansion during a time of average, average inflation over the last number of centuries. Moreover, the three most pernicious deflationary periods of the past century did not start because inflation was too close to zero. They were preceded by asset bubbles. If I were trying to create a deflationary bust, I would do exact exactly what the world’s central bankers have been doing the last six years. I shudder to think that the malinvestment that occurred over this period. Corporate debt has soared, but most of it has been used for financial engineering. Bankruptcies have been minimal in the most disruptive economy since the Industrial Revolution. Who knows how many corporate zombies are out there because free money is keeping them alive? Individuals have plowed ever-increasing amounts of money into assets at ever-increasing prices, and it is not only the private sector that is getting the wrong message, but Congress as well. I have no doubt we would have not gotten such a big increase in fiscal deficits if policy had been normalized already. Of all the interventions by the not-so-invisible hand, not allowing the market to set the hurdle rate for investment is the one I see with the highest costs. Competition is a better tool than price control for protecting consumers. That applies to Amazon and the bond market. The government should get out of the business of manipulating long-term interest rates and canceling market signals. |

A source of news, research and other information that we consider informative to investors within the context of tail hedging.

The RSS Feed allows you to automatically receive entries

Archives

June 2022

All content © 2011 Lionscrest Advisors Ltd. Images and content cannot be used or reproduced without express written permission. All rights reserved.

Please see important disclosures about this website by clicking here. |

RSS Feed

RSS Feed