|

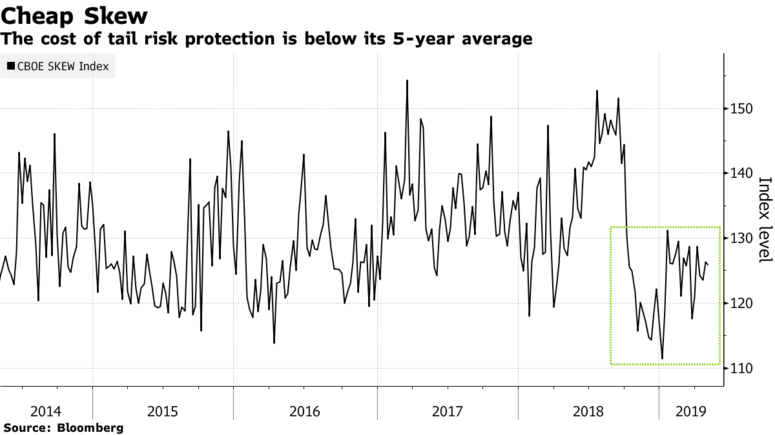

By Ksenia Galouchko April 30, 2019, 9:34 AM CDT There’s a silver lining for bears getting destroyed by record U.S. stock prices and the relentless credit boom: Prepping for Armageddon has rarely been so cheap. Just ask Mark Spitznagel, the Miami-based investor whose $11 billion black swan fund specializes in hedging against cataclysms on the scale of the dot-com crash and the 2008 financial crisis. “It’s funny that the richer the markets get, which ultimately leads to crashes, the cheaper the insurance,” said Spitznagel, whose Universa fund counts Nassim Taleb as scientific adviser. “I love low vol like this.” It’s the other side of a U.S. stock-market rally that has continued to defy naysayers on the way to notching one of the quickest turnarounds in history. After equity volatility spiked briefly at the end of last year, dovish monetary officials have helped squash swings across asset classes, making derivatives such as those scooped up by Universa historically cheap. “Low implied volatility, low VIX is always a good a thing for me,” Spitznagel said in an interview in London. Funds like Universa focus on protecting client portfolios from tail events, typically defined as those that are more than three standard deviations from the norm, or which have a 0.3 percent chance of coming to pass. Along with the likes of Richard “Jerry” Haworth’s 36 South Capital Advisors LLP, these niche managers skyrocketed to fame after posting outsize returns during 2008’s rout. These players rely on far out-of-the-money put options that are likely to gain in value only in extreme market scenarios and possess “convexity,” or extreme sensitivity to price movements. Subdued expectations of a volatility maelstrom have made these contracts considerably cheaper. CBOE’s SKEW index, one measure of the cost of tail protection, sits below its five-year average. Gauges of implied volatility across rates and currencies -- which inform options prices -- have also dropped to multi-year lows. Strategists at BNP Paribas SA and JPMorgan Chase & Co. have recommended that investors take advantage of these conditions to stock up on cheap protective hedges in the event of a downturn.

Spitznagel says central banks and their “unprecedented period of monetary interventionism’’ are firmly behind the low-vol trend. “All assets are priced where they are today because of central banks,” he said. “That’s modern finance -- it’s not about psychology or flows anymore, it’s about what the central banks are going to do next.” With the post-crisis bull market defying incessant talk of its demise and the credit supercycle extending in earnest, there’s been a shift in demand for black swan strategies, according to Spitznagel. Clients today are donning protection in order to up their risk exposures elsewhere in their portfolio rather than in anticipation of a near-term market collapse, he said. Spitznagel declined to reveal inflows or returns for this year. A 2018 investor letter seen by Bloomberg showed that an equity portfolio with a small allocation to Universa posted a compound annual growth rate of 12.3 percent over the previous decade. The worst annual performance was 0.6 percent. “What I allow investors to do is take more systematic risk and not suffer the consequences in case of a crash,” he said. Despite the meteoric post-crisis rise in exchange-traded products tracking volatility, Spitznagel slams investors who buy them them as portfolio hedges. “They don’t even begin to understand them,’’ he said. “It’s just a really bad retail product. It’s probably a bad institutional product for most.” |

A source of news, research and other information that we consider informative to investors within the context of tail hedging.

The RSS Feed allows you to automatically receive entries

Archives

June 2022

All content © 2011 Lionscrest Advisors Ltd. Images and content cannot be used or reproduced without express written permission. All rights reserved.

Please see important disclosures about this website by clicking here. |

RSS Feed

RSS Feed