|

Investors need to appreciate the disconnect that can emerge between the price of risk in the market and the actual risks. by Dean Curnutt Bloomberg View 2 May 2017 Amid an improbable level of calm in markets, it’s worth remembering what Victor Haghani, a partner at Long-Term Capital Management, said in early 1999 about the fund’s implosion, especially given that quiet markets are compelling trading strategies that capitalize on low levels of volatility.

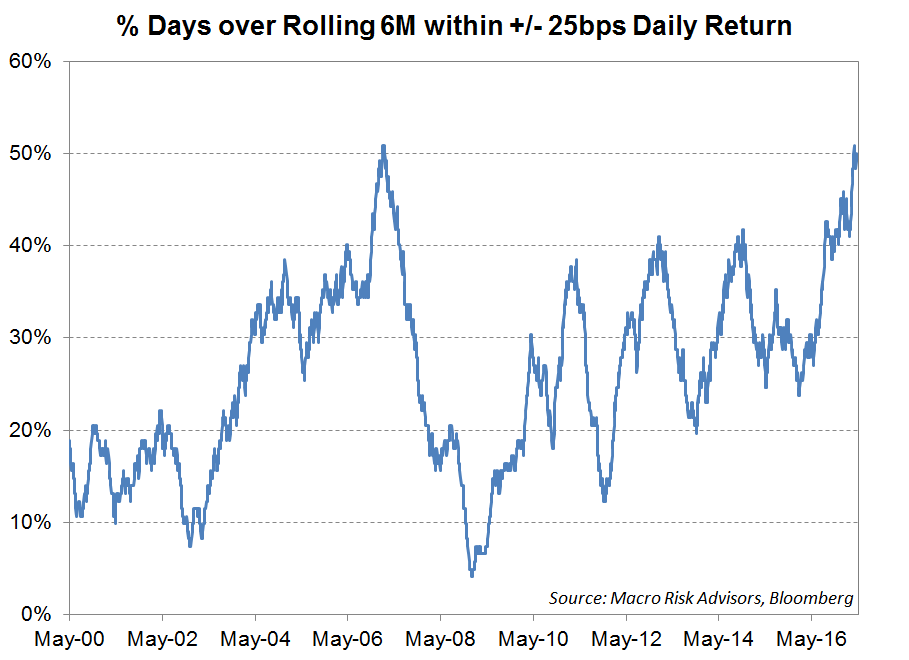

While Haghani’s statements were focused on the manner in which LTCM-specific trades were seemingly attacked by the market, they remain highly relevant today because the notion that financial market insurance is not like hurricane insurance is broadly applicable. When trades are especially crowded, their unwinding can amplify market moves as investors seek to de-risk in unison. Stable markets not only invite trades that bet on the continuation of stability, they almost force investors to pursue them in an investment climate so deprived of nominal return. Over the most recent six-month period, the realized volatility of the S&P 500 has been lower than at any time since before the financial crisis. Importantly, this period of market tranquility has generated huge profits for trading strategies that capitalize on stability by selling options. While there is an almost limitless supply of industry analysis on the current low level of the CBOE Volatility Index, or VIX, the real story has been the consistency with which the index has overstated the actual movement in the market. How low has volatility been? Over the last six months, more than half of the days have had a less than 25 basis-point return. These are “home run” results for option sellers. Even as markets appear stable, we should appreciate the risks. While Mother Nature dictates the timing and severity of the next hurricane, the financial market equivalent may arise endogenously, propelled by the forceful unwind of trades that enjoyed too much success for too long. Winning trades attract money, and as capital flows in to them, they become increasingly crowded. In markets, positioning matters. The Nomura Equity Volatility Risk Premium Fund, which systematically sells equity index variance swaps, has enjoyed quite a run. Since the U.S. election, it has lost money on just 27 percent of trading days. The average loss on such days has been a mere 19 basis points. The six month Sharpe Ratio of the strategy is north of 6. Strategies that make money nearly all the time, and only lose fractionally on the days they don’t are beyond appealing to investors.

The standard disclaimer “past performance is no guarantee of future results” tends to be ignored when strategies generate consistent profits with seemingly low risk. This is especially the case in a world bereft of interest income and as the expected future return prospects for the traditional 60/40 stock/bond portfolio appear unconvincing. With both stock and bond valuations at stretched levels, investors are being forced into “alternative risk premia” like the one offered by the Nomura fund. While the unprecedented market swings during the financial crisis imposed massive drawdowns on short volatility strategies, handsome profits have since been generated betting against a repeat of that market chaos. Over long periods of time, there are few trades that hold up as well as selling equity volatility. Faced with the daunting task of achieving 8 percent return targets, many pension funds have “bought the back-test” and are actively generating returns through short option strategies. Ten years after the early onset of the financial crisis, investors must appreciate the disconnect that can emerge between the price of risk in the market and the actual risks that may be in the process of materializing. In early 2007, the VIX dipped below 10, pulled down then -- like now -- by 6 percent realized volatility. Then, even as short volatility strategies profited from the very muted daily fluctuations in the S&P 500 Index, a tidal wave of systemic risk was already in motion. Over the first quarter of 2007, the mortgage industry began its collapse with a series of bankruptcies by subprime lenders. The severity of what would unfold over the next two years resulted from the one-sided positioning in the market that had built up over years based on faulty assumptions relating to credit risk and housing price appreciation. It is easy to argue that today’s financial system is safer than that of the pre-crisis era. Wall Street banks run with considerably less leverage than they did a decade ago. Further, the speculative excess in housing and the shadow bank securitization built around it is not nearly as prominent. These differences acknowledged, the current period and that of a decade earlier are similar in sharing a protracted decline in realized volatility. In one of the most ironic set of comments ever made by a policy maker, Fed Chairman Alan Greenspan said at the 2005 Jackson Hole confab -- with the VIX at 13, realized volatility at 8 and the CDX investment grade index at 50 -- that history “has not dealt kindly with the aftermath of protracted periods of low risk premiums.” Investors should heed those words. Comments are closed.

|

A source of news, research and other information that we consider informative to investors within the context of tail hedging.

The RSS Feed allows you to automatically receive entries

Archives

June 2022

All content © 2011 Lionscrest Advisors Ltd. Images and content cannot be used or reproduced without express written permission. All rights reserved.

Please see important disclosures about this website by clicking here. |

RSS Feed

RSS Feed