|

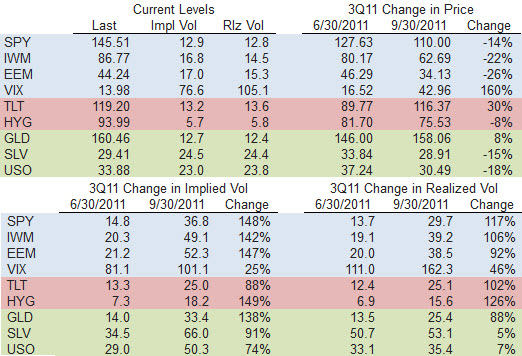

Source – Global investment bank Jefferies One of the largest potential volatility events for the equity markets this year will be the Q1 US Debtapalooza. There are three main issues that are to be debated with a crescendo coming in late February – the Long Term Budget Deal, the 2013 Budget Deal and the Debt Limit. There will obviously be many consequential threats and theatrics associated with these events – including potential threats for government shutdowns and debt defaults – while the very real consequences could be additional US ratings downgrades. It is important to remember that outside of the 2008 shock, the Debt Ceiling Debate and consequent US Debt Downgrade in Summer 2011 created the biggest volatility event of the past two decades. S&P 500 Realized 15-Day Vol - August 2011 was a massive event: Volatility metrics show that the market is extremely complacent heading into these events. Equity volatility and skew [volatility across strike prices] are trading near multi-year lows (5th percentile or less over past two years), while many market indices are making new multi-year highs. From a positioning standpoint, net exposures are higher than any time in 2012 while hedges are at multi-year lows. Total S&P500 Put Open Interest has fallen from 9.5mm contracts to 5.7mm contracts in the past month – This is the lowest level of puts outstanding for the S&P500 since June 2009. The bottom-line is that we are heading into a potential multiple-standard deviation volatility event with the price of options at their lows and market exposures/equity prices at their highs. 3Q11 changes in price, front month put implied volatility, and 90-day realized volatility across asset classes: Hat-tip Zerohedge

Comments are closed.

|

A source of news, research and other information that we consider informative to investors within the context of tail hedging.

The RSS Feed allows you to automatically receive entries

Archives

June 2022

All content © 2011 Lionscrest Advisors Ltd. Images and content cannot be used or reproduced without express written permission. All rights reserved.

Please see important disclosures about this website by clicking here. |

RSS Feed

RSS Feed