|

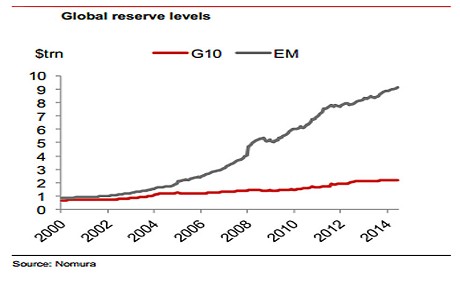

By Ambrose Evans-Pritchard 30 July, 2014 The spigot of global reserve stimulus is slowing to a trickle. The world's central banks have cut their purchases of foreign bonds by two-thirds since late last year. China has cut by three-quarters. These purchases have been a powerful form of global quantitative easing over the past 15 years, driven by the commodity bloc and the rising powers of Asia. They have fed demand for US Treasuries, Bunds and Gilts, as well as French, Dutch, Japanese, Canadian and Australian bonds and parastatal debt, displacing the better part of $12 trillion into everything else in a universal search for yield. Any reversal would threaten to squeeze money back out again. Jens Nordvig, from Nomura, said net foreign reserve accumulation by central banks fell to $63bn in the second quarter of this year, from $89bn in the first quarter, and $181bn in the fourth quarter of 2013. These data are adjusted for currency swings, and are fresher than the delayed figures published by the International Monetary Fund. "There are major shifts going on global capital markets. People have been lulled into a false sense of security by low volatility and they haven't paid attention. We're not seeing any risk aversion in financial markets," he said. The world superpower in this game is China, with reserves just shy of $4 trillion. Mr Nordvig estimates that China's purchases dropped to $27bn in the last quarter, down from $106bn in the preceding quarter. This looks like a permanent shift in policy. Premier Li Keqiang said in May that the reserves had become a "big burden" and were doing more harm than good, playing havoc with monetary policy, as global economists have been warning for a long time. China's policy of holding down the yuan for mercantilist trade advantage caused it to import excess stimulus from America at the wrong moment in its own cycle, causing China's credit boom to go parabolic as loans rose from $9 trillion to $25 trillion in five years. Russia is drawing down on its $480bn reserves for an entirely different reason. The central bank has run through $40bn since the Ukraine crisis erupted as it tries to shore up the rouble. This is surely going to get worse as Western sanctions bite in earnest, shutting energy companies and banks out of global capital markets. The central bank has already flagged it will step in to help companies roll over foreign debt, maturing at a rate of $10bn a month. The European Commission stated openly in a leaked briefing paper last week that the aim of the funding freeze for Russian banks is to force them into the arms of the state, bleeding the Kremlin coffers. The implication of the global reserve data is that this form of QE is being run down just as the US Federal Reserve runs down its own QE by tapering bond purchases, and then prepares to tighten. The global central banks have been buying around $250bn of bonds a month in one form or another for most of the past three years. This is being cut to a fraction. Global reserve accumulation works like QE by the Fed, which openly admits that the purpose is to drive up asset prices, and thereby ignite the kindling wood of recovery. But the global variant has been much larger, soaring from 5pc to 13pc of world GDP since 2000. Edwin Truman, from the Peterson Institute in Washington, says the figure is nearer 22pc - or $16.2 trillion - if sovereign wealth funds are included. This has been a wall of money pushing into asset markets, part of what former Fed chief Ben Bernanke called the "Asian savings glut". You could argue that these reserves and quasi-reserves were the biggest single cause of the worldwide credit bubble before the system blew up in 2008. They are one reason for the "puzzling disconnect between the markets’ buoyancy and underlying economic developments globally" that we are seeing now, to cite the Bank for International Settlements. It is remarkable that global equity markets have been surging this year even though world trade has been sputtering, and actually contracted by 0.6pc in May, according to the Dutch CPB World Trade Monitor. This is the triumph of excess global capital over the real economy, and by implication a victory for shareholders and property owners over workers and wage-earners. If it is true that reserve accumulation causes asset bubbles and dangerous carry trades of every kind - as suggested in a series of IMF papers - then any sign that it is slowing and might even be going into reverse ought to be a cautionary warning. We had a taste of this in the Great Recession when emerging markets suddenly began to liquidate reserves to defend their currencies, causing a liquidity crunch that compounded the global crisis. These reserve figures are opaque and difficult to interpret. A recent survey of central banks, wealth funds and government pension funds by the monetary forum OMFIF estimated that they have $29 trillion invested in global markets, and that they too have joined the scramble for yield. The study said the Chinese central bank, PBOC, and others had become "major players on world equity markets", effectively fuelling stock bubbles in much the same way they previously fuelled credit bubbles. "It appears that PBOC itself has been directly buying minority equity stakes in important European companies," it said.

It is possible that central banks are simply rotating from bonds into equities, deemed less vulnerable to a bond sell-off if inflation picks up again. Mr Nordvig said Nomura's data capture all of the flows and these show that pace is slowing. "I would miss it only if the money was being funnelled into a secret sovereign wealth fund," he said. Some hope the European Central Bank will pick up the baton as the Fed bows out, launching QE on a comparable global scale. They are counting on a seemless transition. Yet the ECB will act only if forced to do so by deflationary shocks, and even then without conviction, like the tentative thrusts of the Bank of Japan in the pre-Abe era. Political resistance in Germany is paralysing. Besides, the long-feared moment of Fed tightening is drawing much closer. US unemployment has already dropped to 6.1pc, 14 months earlier than the Fed expected. The US is near the "NAIRU" moment when labour shortages cause wage-price pressures. We are entering a treacherous phase when the central bank fraternity is switching sides, for various reasons, knocking away a central prop of the asset edifice. In theory this is exactly what should happen. Economic gains may be driven once again by technology, not by artifice. The savings glut may melt slowly into real demand. Yet it would surely be a miracle if we can extract ourselves so easily from an unprecedented experiment over the 15 years that has driven total debt ratios to a record 275pc of GDP in the rich states, and a record 175pc in emerging markets. The whole world is leveraged to the slightest error now made by central banks. Comments are closed.

|

A source of news, research and other information that we consider informative to investors within the context of tail hedging.

The RSS Feed allows you to automatically receive entries

Archives

June 2022

All content © 2011 Lionscrest Advisors Ltd. Images and content cannot be used or reproduced without express written permission. All rights reserved.

Please see important disclosures about this website by clicking here. |

RSS Feed

RSS Feed