|

Source: Zerohedge

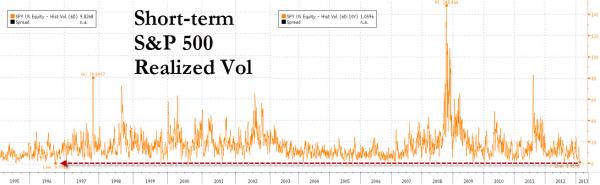

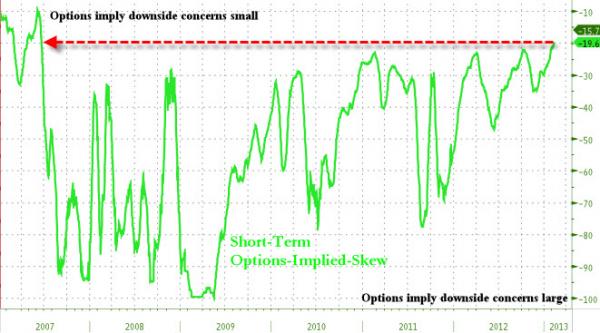

It is perhaps no surprise that VIX has dropped to new six year lows today as the volatility of the underlying equity market has now been repressed to its lowest point is 17 years. Not since 1996 has short-term realized volatility been this low. The premium (between implied and realized volatility) continues to compress as options traders scalp the difference but increasingly that trade will feel like those nickels just ain't worth the impending steam-roller's wrath. As we noted last night, implied vol skews are as complacent to any downside risk as they have been since before the crisis was even being considered. Comments are closed.

|

A source of news, research and other information that we consider informative to investors within the context of tail hedging.

The RSS Feed allows you to automatically receive entries

Archives

June 2022

All content © 2011 Lionscrest Advisors Ltd. Images and content cannot be used or reproduced without express written permission. All rights reserved.

Please see important disclosures about this website by clicking here. |

RSS Feed

RSS Feed