|

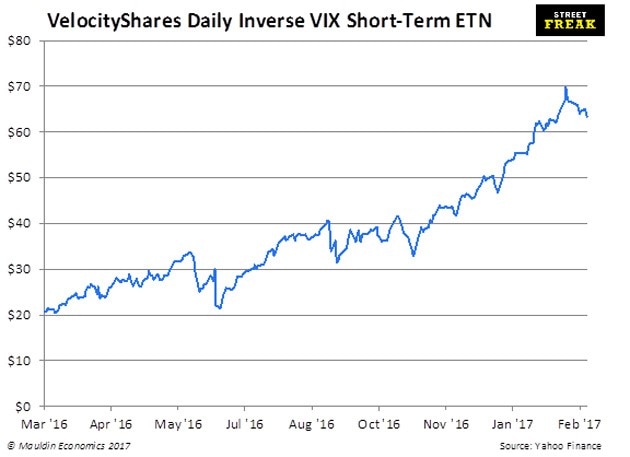

by Jared Dillian The 10h Man - Mauldin Economics March 2, 2017 You might remember The Incredible Drinking Bird joke from an old Simpsons episode. Homer wants to take a break from work, so he gets The Incredible Drinking Bird to hit the same key on the keyboard for him while goes out for a beer. The Incredible Drinking Bird is sort of a perpetual motion machine—it has a felt beak that dips in a glass of water, and then some chemical stuff happens in that bowl in the tail as the water evaporates and the bird tips over again. I had a colleague at Lehman Brothers who joked that the French banks got The Incredible Drinking Bird to hit the “sell vol” key on their keyboards. They just sold calls and puts on a daily basis, driving the vol into the mid-single digits. We joked that they probably booked the entire premium of the option as profit at the time of sale. Looks like someone has The Incredible Drinking Bird out there selling vol again. Check out this chart—there is always a bull market somewhere: That’s the chart of the inverse VIX ETN. Yes, there is such a thing, though it only has just over $500 million in assets.

Interesting tidbit about XIV: if the VIX were to go up a lot—say, 80% in a day—then XIV would be forced to redeem. It’s happened before, nearly 10 years ago to the day. Speaking of which, do you remember where you were on February 27, 2007? That was the opening salvo of the financial crisis, the day when the ABX gagged and China raised reserve requirements. We went from zero to OMG in the span of an afternoon. I tell people this all the time—in my entire career, I have never seen anything that crazy. It was also the highest vol-of-vol day in history. There is a lot of vol selling out there. People are willing to sell puts and calls for not very much, just to get a little yield out of their portfolio. And this, boys and girls, is one of the direct consequences of Zero Interest Rate Policy—people are incentivized to take stupid risks just to get a little yield. There were rumors going around last week about a fund getting itself into trouble by selling 1x5 upside call spreads, covering billions of delta as the market rallied. Nobody knows for sure if that’s what was driving the stock market higher, but it was a plausible theory, and it’s exactly the kind of behavior that gets people in trouble. Stress Test Here’s an exercise that we should all go through right now. You should stress test your portfolio. Picture some hypothetical awful situation—North Korea lobs a nuke into San Francisco, a true black swan—and try to predict how your portfolio would react in that disaster scenario. Do you feel like you have adequate protection? Oftentimes, buying protection for events like this is prohibitively expensive. Not now, though—now it is about as cheap as it gets. There is no reason not to own it. A lot of people will misinterpret me and say, “Dillian thinks something really bad is going to happen.” That is not the case at all. Really bad things are really unlikely. All I’m saying is, the cost of protecting yourself against really bad things can’t get much lower. But I will also say that it’s in times when people are most complacent that they should be the most vigilant. Usually it is the other way around—people are most vigilant when they should be complacent (like in the teeth of the financial crisis). I have been picking up anecdotes here and there. I’m sure many of you have come home from work to watch the Nightly News, only to have your spouse observe that the Dow is making record high closes on a daily basis, are we making money? Whenever you hear stories like that—run! There is an old saying on Wall Street: Buy it when you can, not when you have to. You can buy the one month puts in the S&P at a 7 vol. You have to when they’re at a 40 vol. Not to mention common sense. If you think we are getting through four years of a Trump/Bannon administration with the market this soporific, you are nuts. You Might Want to Rethink That Instead of selling options, how about buying options? I’m sure there are lots of covered call writers on this distribution. How about you stop writing covered calls? You are getting virtually nothing. Let me rephrase that: You are trading away all the upside and getting virtually nothing in return. Same goes for selling cash-secured puts. Better to do that when vol is high, not when vol is low. I’ve talked a lot about buying downside protection, but why not buy some upside as well? I really like “right-tail” strategies in the index, like buying the long-dated 3000 strike calls in the S&P 500. It’s only about a 30% move—not all that improbable. Plus, you get all the rho.1 I know people who absolutely cannot bring themselves to buy an option. As they say, 90% of them finish out of the money.2 If nothing else, buying options is a good regret-minimization strategy. Think of it as investing in mental capital. Take a few thousand bucks and just spend it on being able to sleep soundly at night. Sounds like a good investment to me. _____ 1 Exposure to higher interest rates. 2 I have no idea if this is true. Comments are closed.

|

A source of news, research and other information that we consider informative to investors within the context of tail hedging.

The RSS Feed allows you to automatically receive entries

Archives

June 2022

All content © 2011 Lionscrest Advisors Ltd. Images and content cannot be used or reproduced without express written permission. All rights reserved.

Please see important disclosures about this website by clicking here. |

RSS Feed

RSS Feed