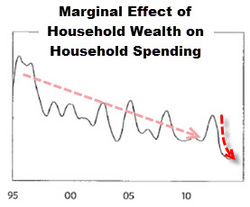

In the old days central banks moved interest rates to run monetary policy. By watching the flows, we could see how lowering interest rates stimulated the economy by 1) reducing debt service burdens which improved cash flows and spending, 2) making it easier to buy items marked on credit because the monthly payments declined, which raised demand (initially for interest rate sensitive items like durable goods and housing) and 3) producing a positive wealth effect because the lower interest rate would raise the present value of most investment assets (and we saw how raising interest rates has had the opposite effect). All that changed when interest rates hit 0%; "printing money" (QE) replaced interest-rate changes. Because central banks can only buy financial assets, quantitative easing drove up the prices of financial assets and did not have as broad of an effect on the economy. The Fed's ability to stimulate the economy became increasingly reliant on those who experience the increased wealth trickling it down to spending and incomes, which happened in decreasing degrees (for logical reasons, given who owned the assets and their decreasing marginal propensities to consume). As shown in the chart on the right, the marginal effects of wealth increases on economic activity have been declining significantly. The Fed's dilemma is that its policy is creating a financial market bubble that is large relative to the pickup in the economy that it is producing. If it were targeting asset prices, it would tighten monetary policy to curtail the emerging bubble, whereas if it were targeting economic conditions, it would have a slight easing bias. In other words, 1) the Fed is faced with a difficult choice, and 2) it is losing its effectiveness. Comments are closed.

|

A source of news, research and other information that we consider informative to investors within the context of tail hedging.

The RSS Feed allows you to automatically receive entries

Archives

June 2022

All content © 2011 Lionscrest Advisors Ltd. Images and content cannot be used or reproduced without express written permission. All rights reserved.

Please see important disclosures about this website by clicking here. |

RSS Feed

RSS Feed