|

A ‘Black Swan’ fund that has managed to make money in the great bull market is taking advantage of what it sees as overvaluation and investors’ complacency to reap a far bigger bonanza By Spencer Jakab Sept. 21, 2018 The 10th anniversary of the financial crisis is a natural time to fret about the next bust, but betting against the market is usually a loser’s game. Or is it? Record stock prices, bubbling trade wars, Donald Trump’s legal peril and sputtering emerging markets give some teeth to fears of another market rout. So did a host of mostly forgotten crises—Brexit, the fiscal cliff, the taper tantrum—that turned out to be great buying opportunities. The S&P 500 has returned over 200% since the day Lehman Brothers went bust—more fodder for the investing classic “Triumph of the Optimists” that underlines the benefits of staying in the market through thick and thin. So why is a man who has made a huge wager on another market collapse so happy? It isn’t because he sees an imminent crash, though he doesn’t rule it out. It is because almost no one else is preparing for one. “I spend all my time thinking about looming disaster,” says Mark Spitznagel, chief investment officer of hedge fund Universa Investments, who predicts a major decline in asset prices but can’t say when. He admits that the bull market could keep going for years. “Valuations are high and can get higher.”

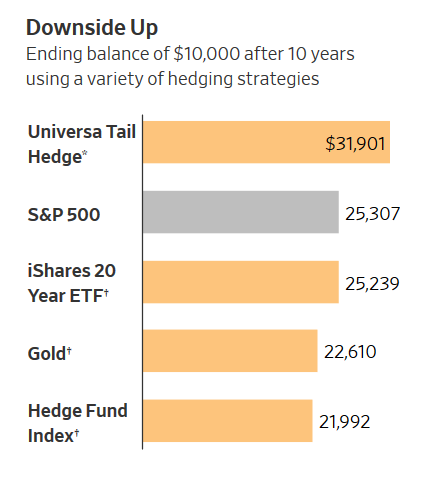

Talk is cheap in investing punditry and predicting a decline without saying when it will happen is cheapest of all. Yet Universa’s stance warrants attention, and not only because it backs its views with billions of dollars and is advised by author Nassim Nicholas Taleb of “Black Swan” fame. Mr. Spitznagel isn’t betting on some unpredictable event causing a crisis but instead a predictable one—an eventual blowback from unprecedented central-bank stimulus. What sets the fund apart and why investors should pay attention is that Mr. Spitznagel’s clients have done well without a crisis. Founded in 2007, Universa was among a handful of funds that made huge gains in 2008. Unlike some crisis-era legends such as John Paulson, David Einhorn and Steve Eisman who have struggled mightily since then, Mr. Spitznagel has enjoyed mini-bonanzas along the way. In August 2015, for example, his fund reportedly made a gain of about $1 billion, or 20%, in a single, turbulent day. A letter sent to investors earlier this year said a strategy consisting of just a 3.3% position in Universa with the rest invested passively in the S&P 500 had a compound annual return of 12.3% in the 10 years through February, far better than the S&P 500 itself. It also was superior to portfolios three-quarters invested in stocks with a one-quarter weighting in more-traditional hedges such as Treasurys, gold or a basket of hedge funds. “This is a very good time for us,” he says. Comments are closed.

|

A source of news, research and other information that we consider informative to investors within the context of tail hedging.

The RSS Feed allows you to automatically receive entries

Archives

June 2022

All content © 2011 Lionscrest Advisors Ltd. Images and content cannot be used or reproduced without express written permission. All rights reserved.

Please see important disclosures about this website by clicking here. |

RSS Feed

RSS Feed