|

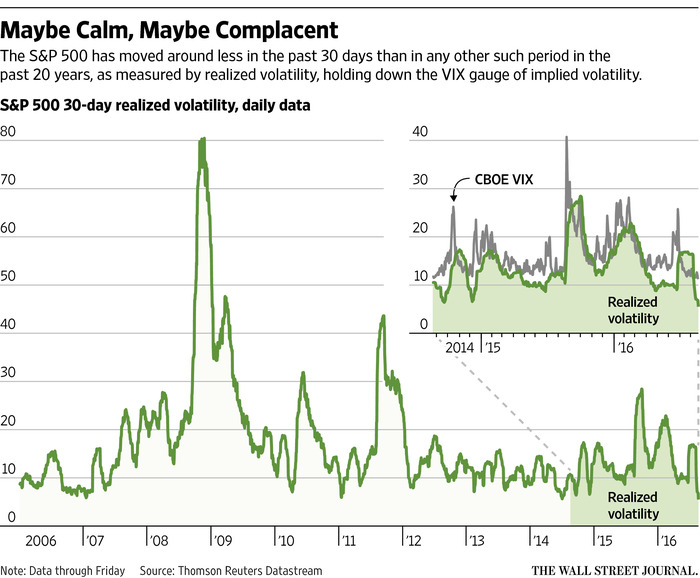

by James Mackintosh August 23, 2016 Calm has descended on the U.S. stock market. The past 30 days have been the least volatile of any 30-day period in more than two decades. Only five days during the most recent stretch saw the S&P 500 move by more than 0.5% in either direction, the lowest since the fall of 1995. Back then, the Federal Reserve was paused between rate cuts. This time around, a combination of the summer lull in trading and super-easy global monetary policy has helped drive volatility to levels seen only a dozen times in the past half-century. “Last week and the week before, you had to make sure your machine was actually on because it was flashing so infrequently,” said Jared Woodard, a strategist at Bank of America Merrill Lynch, referring to the changes in stock prices on computer terminals. The quiet market, measured by the realized volatility—a measure of how much share prices move around—of the S&P 500, has led some to worry that a market storm may be brewing, as peaceful periods in the past have frequently ended in sharp corrections. Implied volatility, a measure of stocks’ expected future volatility and of the cost of options, has collapsed alongside realized volatility. The CBOE VIX index on Friday dropped to levels last seen in the summer of 2014—a period of calm that ended decisively with panic buying of bonds that October. The VIX, seen as Wall Street’s fear gauge, rose slightly on Monday, as the S&P fell fractionally to 2182.64. Previous periods of very low volatility were in early 2011, before the U.S.’s near-default and loss of triple-A status, and January 2007, a few months before the collapse of two Bear Stearns Cos. hedge funds marked the beginning of the credit crunch. There is more going on now than just the summer holidays. The markets are very rarely this serene, with S&P 500 realized volatility lower only a dozen times in the past half-century. In data back to 1928, this level of volatility appeared frequently only during the period from the 1951 removal of the Federal Reserve’s cap on bond yields to President Richard Nixon’s 1971 scrapping of the dollar’s link to gold. Mr. Woodard said Britain’s vote in June to leave the European Union had shocked investors, many of whom then closed their big market positions. Without many aggressive bets, there has been less need to trade on the news—and there hasn’t been much news, anyway. Investors have become more relaxed as this year’s rebound has continued, but surveys and market technical measures don’t suggest they are gripped by complacency.

Excuses can be made for the low level of the VIX, too. The implied volatility measured by the VIX should offer a premium to realized volatility, a reward for the risk taken by option sellers. Excessive complacency should show up in a shrinking risk premium, but at the moment, the gap between the VIX and realized volatility is roughly in the middle of its range from the past 20 years. The same is true for the gap between implied volatility of the next few months and further ahead. Investors seem to think volatility will pick up a bit, and again the oddity is where it stands now, not what investors are doing. “Everything feels distorted and unnatural; you know the source of that is the central banks but equally there’s nothing to stop them carrying on,” said Matt King, head of credit strategy at Citigroup. Wall Street has long seen central-bank action through the lens of the options market, since Alan Greenspan’s tenure as Fed chairman. The “Greenspan put” has under current Fed chief Janet Yellen become the “Yellen put,” named for an option used to protect against falling prices. If the Fed offers free insurance, there is no point buying your own, which ought to keep the price of puts—that is, implied volatility—down. Faith in how far central banks will protect against losses comes and goes, though. In market-speak, the Yellen put is less out of the money if a smaller price fall pushes the Fed to act. At the moment, investors seem to think the put is barely out of the money at all. The danger, then, is not so much complacency about markets, but complacency about central banks. The lesson of the past seven years is that policy makers will step in every time disaster strikes. But investors tempted to rely on the central banks should note that disasters did still strike, and markets had big falls before help arrived. The time to buy insurance is when it is cheap, and for the U.S. stock market, that is now. Comments are closed.

|

A source of news, research and other information that we consider informative to investors within the context of tail hedging.

The RSS Feed allows you to automatically receive entries

Archives

June 2022

All content © 2011 Lionscrest Advisors Ltd. Images and content cannot be used or reproduced without express written permission. All rights reserved.

Please see important disclosures about this website by clicking here. |

RSS Feed

RSS Feed