|

What is the VXO?

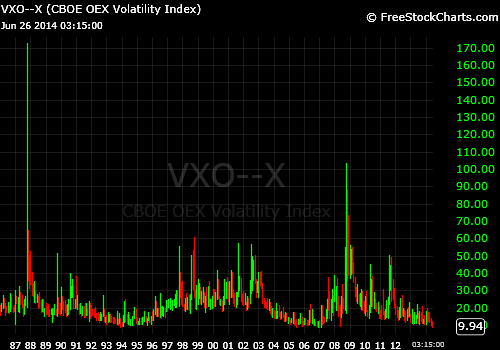

"The CBOE Volatility Index® (VIX®) is a key measure of market expectations of near-term volatility conveyed by S&P 500 stock index option prices. Since its introduction in 1993, VIX has been considered by many to be the world's premier barometer of investor sentiment and market volatility. The CBOE began disseminating prices for a VIX Index with a new methodology (Acrobat .pdf) on September 22, 2003." - Chicago Board Options Exchange (CBOE) Prior to September 22, 2003, the "VIX" was based on the OEX 100, "a sub-set of the S&P 500, measures the performance of large cap companies in the United States. The Index comprises 100 major, blue chip companies across multiple industry groups." - S&P Dow Jones The VXO continues to trade as a more concentrated version of the VIX die to its focus on large-cap stocks. Comments are closed.

|

A source of news, research and other information that we consider informative to investors within the context of tail hedging.

The RSS Feed allows you to automatically receive entries

Archives

June 2022

All content © 2011 Lionscrest Advisors Ltd. Images and content cannot be used or reproduced without express written permission. All rights reserved.

Please see important disclosures about this website by clicking here. |

RSS Feed

RSS Feed