JPM's Head of Equity Derivatives Strategy, Marko Kolanovic, speaks to heightened tail-risks19/6/2013

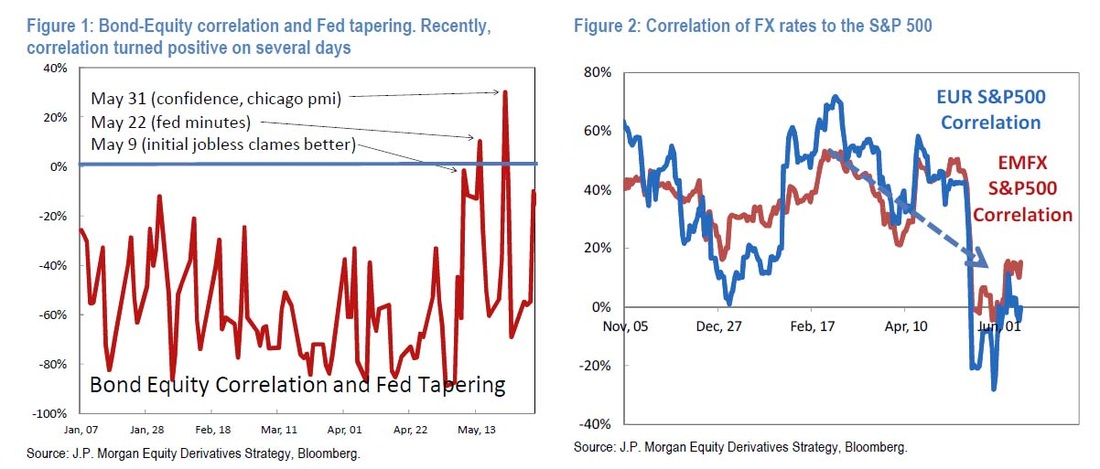

17 June 2013 Over the last 5 years, Treasuries and equities had strong negative correlation. This was the risk-on / risk-off (RORO regime) in which Treasuries were the most broadly used ‘safe haven’ asset. In the RORO regime, investors would hold treasuries and sell them to buy risky assets (and vice versa) while being reassured that Fed will keep the price of Treasuries supported. While we are still on average in a RORO regime, the bond-equity correlation started significantly weakening due to increased risk of Fed tapering and a bond selloff. The effect of the Fed reducing the stimulus could result in lower bond prices as well as lower prices of stocks, commodities and other risky assets whose prices were inflated by the Fed’s stimulus. Over the past month, in several instances bonds and stocks moved together as investors re-assessed the probability of early tapering. Figure 1 below shows equity-bond correlation (calculated from high frequency intraday data). Correlation turned positive on May 9, 22, and 31 and most recently over the past few days. May 9th and 31st brought better than expected macro data (jobless claims, consumer confidence and Chicago PMI). Ironically, positive data caused equities and bonds to trade lower on increased probability of tapering (good data were bad for stocks). Similarly, on May 22nd, bonds and stocks sold off as Bernanke indicated the possibility of tapering over the next few meetings. A byproduct of these new bond-equity dynamics is that USD is losing its status as a ‘risk off’ currency. As expectations of more (less) stimulus pushes up (down) treasuries and US stocks (both USD denominated), resulting currency flows are weakening the historical negative USD-equity correlation. Historically, USD had strong negative correlation to equities (i.e. EUR and EM currencies had a positive correlation to equities). This recent relationship is now undermined as treasuries are losing their appeal as a safety asset. This weakening of EM FX and EUR correlation to the S&P 500 (Figure 2) was also helped by investors putting money in US stocks, while avoiding European and Emerging markets in the last leg of market rally. Fears of Fed tapering the massive QE program is now changing bond-equity correlation from a RORO regime towards a ‘Fed Model’ regime (coincidentally, the name ‘Fed Model’ was crafted in 90s long before invention of quantitative easing). We do not think equity-rate correlation will fully revert back to the ‘Fed Model’ regime, but the recent spikes in rate-equity correlation are worrying signs. Recent bouts of positive correlation of equities, bonds and commodities, suggest that the Fed’s stimulus inflated prices of a broad range of financial assets, and removal of the stimulus could create a tail event in which prices of all assets could go down. While it is expected that the Fed will try to avoid such a scenario by maintaining an appropriate level of stimulus, in the absence of more robust growth, this may turn out to be a difficult task (akin to driving a car without brakes). On this account, we expect more volatility in H2 as compared to the first part of the year. To reduce risk of a bond and equity tail event, investors could diversify ‘safe haven’ assets away from treasuries and into other assets that are at lower risk in case of tapering. For instance, investors could increase allocations to cash or equity put options.

Comments are closed.

|

A source of news, research and other information that we consider informative to investors within the context of tail hedging.

The RSS Feed allows you to automatically receive entries

Archives

June 2022

All content © 2011 Lionscrest Advisors Ltd. Images and content cannot be used or reproduced without express written permission. All rights reserved.

Please see important disclosures about this website by clicking here. |

RSS Feed

RSS Feed