|

Weekly Market Comment

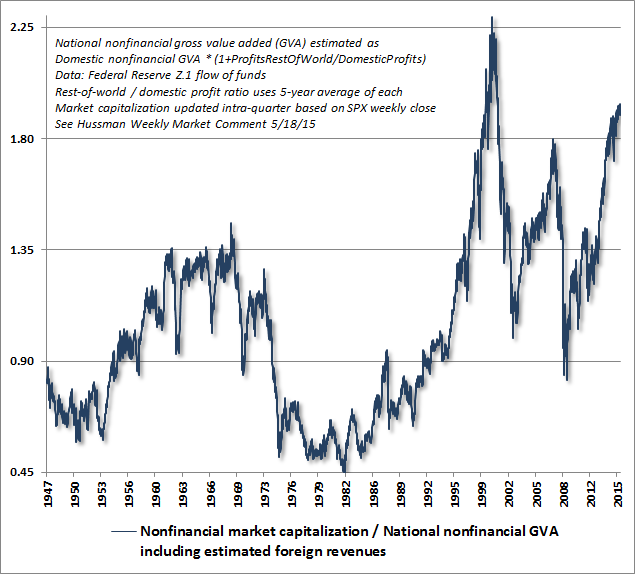

John P. Hussman, Ph.D. August 3, 2015 From our perspective, the fundamental reason for economic stagnation and growing income disparity is straightforward: Our current set of economic policies supports and encourages a low level equilibrium by encouraging debt-financed consumption and discouraging saving and productive investment. We permit an insular group of professors and bankers to fling trillions of dollars about like Frisbees in the simplistic, misguided, and repeatedly destructive attempt to buy prosperity by maximally distorting the financial markets. We offer cheap capital and safety nets to too-big-to-fail banks by allowing them to speculate with the same balance sheets that we protect with deposit insurance. We pursue easy monetary fixes aimed at making people “feel” wealthier on paper, far beyond the fundamental value that has historically backed up that wealth. We view saving as dangerous and consumption as desirable, failing to recognize a basic accounting identity: there can only be a "savings glut" in countries that fail to stimulate investment. We leave central bankers in charge of our economic future because we're too timid to directly initiate or encourage productive investment through fiscal policy. When zero interest rates don't do the trick, we begin to imagine that maybe negative interest rates and penalties on saving might coerce people to spend now. Look around the world, and that same basic policy set is the hallmark of economic failure on every continent. --- Be careful here – deteriorating internals matter. The condition of market internals is precisely the same hinge that – in market cycles across history – has separated overvalued markets that continued to advance from overvalued markets that collapsed through a trap door. That’s not to say that stocks must collapse immediately; market peaks are a process, not an event. That’s also not to say that market internals could not improve, which wouldn’t relieve extreme valuations, but could very well defer their immediate consequences. We’ll take our evidence as it arrives, but at present, we view the condition of the equity market as precarious. As a guide to how we expect the current market cycle to be completed, the chart below presents the ratio of market capitalization/gross value added, which has the strongest correlation with actual subsequent S&P 500 10-year nominal total returns of any valuation ratio we’ve examined across history (including Shiller P/E, market capitalization/GDP, price/revenue, price/dividend, price/book, Tobin’s Q, price/trailing earnings, price/forward earnings, the Fed Model, and other variants). On reliable measures available since the late-1880’s, as well as estimates imputed from historical data, current valuations now easily exceed the 1907 peak, the 1929 peak, the 1937 peak, the 1973 peak, the 1987 peak, the 2007 peak, and indeed every market peak in history except 2000. Moreover, the valuation of the median stock on the basis of price/earnings and price/revenue ratios considerably exceeds the 2000 peak here – because the 2000 peak was more focused on large-capitalization stocks, particularly in the technology sector. Put simply, the recent market peak represents the second most overvalued point in history for the capitalization-weighted stock market, and the single most overvalued point in history for the broad market. Comments are closed.

|

A source of news, research and other information that we consider informative to investors within the context of tail hedging.

The RSS Feed allows you to automatically receive entries

Archives

June 2022

All content © 2011 Lionscrest Advisors Ltd. Images and content cannot be used or reproduced without express written permission. All rights reserved.

Please see important disclosures about this website by clicking here. |

RSS Feed

RSS Feed